Cyprus Business Law Explained: Key Considerations for Entrepreneurs

Understanding the Business Environment in Cyprus

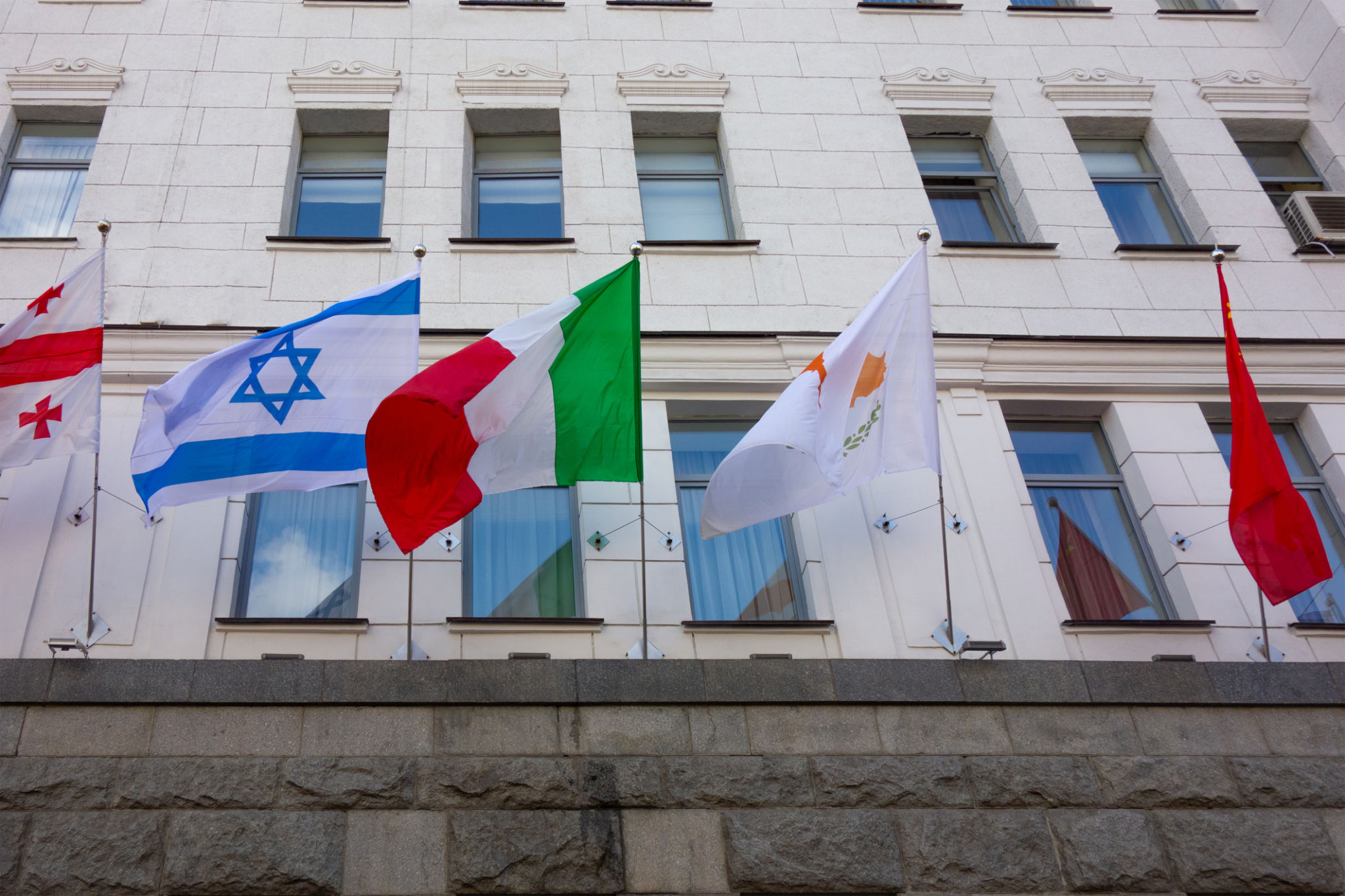

Cyprus has established itself as a robust and dynamic business hub within the European Union, attracting entrepreneurs from all over the world. With its strategic location, favorable tax regime, and business-friendly environment, it's no wonder that many are considering setting up a business here. However, understanding the key considerations of Cyprus business law is crucial for any entrepreneur looking to succeed.

Legal Forms of Business in Cyprus

When starting a business in Cyprus, the first decision to make is the legal form your business will take. The most common types are:

- Private Limited Company (Ltd): This is the most popular structure, providing limited liability to shareholders.

- Public Limited Company (PLC): Suitable for larger businesses intending to raise capital through public offerings.

- Partnerships: Includes general and limited partnerships, suitable for smaller business operations.

Each of these forms has its own set of regulations and requirements, so it is important to choose the one that aligns with your business goals.

Key Regulatory Considerations

Cyprus business law comprises various regulations that entrepreneurs need to adhere to. These include:

- Company Registration: It is mandatory for businesses to register with the Registrar of Companies and obtain a certificate of incorporation.

- Taxation: Cyprus offers a competitive corporate tax rate of 12.5%, one of the lowest in the EU. Understanding tax compliance and planning is essential.

- Employment Law: Regulations concerning employee rights, contracts, and working conditions must be observed.

Intellectual Property Protection

Protecting your intellectual property (IP) is crucial in maintaining a competitive edge. Cyprus law provides robust protection for IP rights, including patents, trademarks, and copyrights. Entrepreneurs should ensure that all their innovations and brand elements are adequately protected under Cypriot law to prevent infringement and unauthorized use.

Banking and Financial Regulations

The banking sector in Cyprus is well-regulated, providing a secure environment for financial transactions. Entrepreneurs will need to open a business bank account as part of their setup process. Additionally, understanding anti-money laundering regulations and ensuring compliance is vital to maintain the integrity of your business operations.

Navigating International Trade and Investment

Cyprus's membership in the EU provides businesses with significant advantages for international trade and investment. Entrepreneurs can benefit from access to the single market, reduced trade barriers, and numerous free trade agreements. However, understanding export regulations and customs procedures is crucial for smooth international operations.

Seeking Professional Legal Advice

Given the complexities of business law in Cyprus, it is advisable for entrepreneurs to seek professional legal advice. Engaging with legal experts who specialize in Cypriot business law can provide valuable insights and ensure compliance with all necessary regulations. This step can save time and prevent potential legal complications down the road.

In conclusion, while Cyprus offers an attractive environment for entrepreneurs, navigating its business laws requires careful consideration and planning. By understanding the key legal considerations and seeking appropriate guidance, entrepreneurs can effectively establish and grow their businesses in this thriving market.